When debt starts to build up, you're suffocating and there is no life raft in sight. Whether it's a few credit cards, personal loans, or student loans, the key to getting back on track is selecting the right repayment plan. The good news is that two of the most popular and effective debt repayment strategies—the debt snowball and debt avalanche—offer a structured approach to becoming debt-free.

Choosing between these debt repayment methods is not something you prefer. It's a question of what works best for your mind, your self-discipline, and your long-term financial goals. This blog presents a full debt snowball vs avalanche comparison, shows you how each method works, which one saves you interest when you pay off debt, and which is one of the fastest debt payoff strategies.

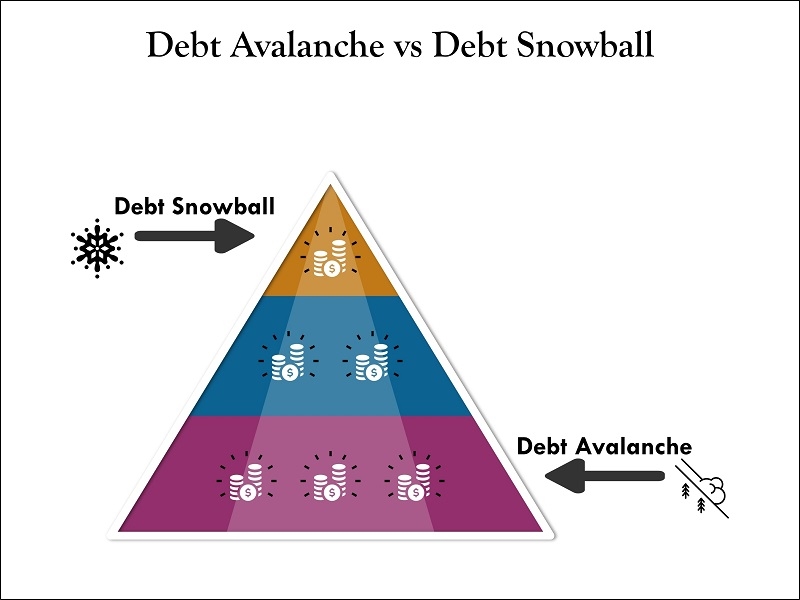

Before we discuss which one is better, let's explain what these two debt repayment strategies are.

Both are solid debt repayment strategies, but they're suited to different personalities and priorities. If you are a fix-it-in-a-hurry type, snowball might be the drink for you. If you like cutting your losses on money, an avalanche might be more for you.

The debt snowball technique is more psychological than strictly mathematical. It's about getting you pumped by feeling quick results, interest rates or not.

Let's consider an example of a debt repayment schedule. Suppose you have:

You'll pay off the $600 debt using the snowball method first. You'll pay extra for that and the minimum for the other two. When the $600 is paid off, you target the $1,200 credit card, and so on. The debt that's paid off gives you a sense of accomplishment and helps to sustain your motivation.

Even though this plan is not the most cost-effective in the long term, it's one of the most satisfying and user-friendly debt repayment methods for individuals who need to track progress in order to stay motivated.

The debt avalanche method is a question of logic and efficiency. You address the debt carrying the largest interest rate first because that's the one stealing from your pocket the fastest.

Stepping back to the example of a debt repayment plan we used above, you'd pay extra on the $1,200 credit card (18%), and minimum payments on the medical bill and the personal loan. This strategy prevents you from paying interest to pay off debt, reducing your overall load.

If you require long-term savings and can keep a plan in place even if it does not offer speedy "wins," the avalanche technique is more effective. It appears as one of the fastest debt payoff strategies when it comes to reducing both time and money in the long run.

When it comes to straight numbers, the debt avalanche strategy blows the competition away in most cases. Paying off the most expensive interest rates first, you pay less in total. But the question is—can you keep it up?

A huge part of being able to pay off debt is psychological. The snowball vs avalanche argument is not so much about savings as it is about sustainability. To someone who's underwater on multiple loans, the snowball strategy gives instant gratification, and the thrill of those immediate wins is what keeps them going.

On the other hand, the avalanche technique can feel like a drag at first, especially if your most important loan is also your largest one. But if you can persevere, this approach will pay almost all interest on debt payoff and make you debt-free faster.

Regardless of the strategy that you implement, it is a good idea to input numbers into a calculator to get an idea of how long and expensive each strategy is going to be. Here is a debt repayment calculator hack:

It’s one of the most eye-opening exercises when choosing your approach. This debt repayment calculator hack isn't information-intensive—it's simplicity. Having your debt journey laid out in front of you can help keep you on track, regardless of whether you continue in snowball or avalanche fashion.

Whether you choose debt snowball or debt avalanche depends on some personal factors:

Emotional Triggers: If you're someone who needs small wins to stay motivated, the snowball method might encourage you even when things get tough.

Financial Logic: If you don't mind delaying gratification to have even more in overall savings, the avalanche method offers you the greater financial payoff.

Discipline Level: Do you have what it takes to work on a plan that won't give you instant gratification? The avalanche is your thing. Otherwise, go snowball and change as you build momentum.

Urgency of Debt: Certain debts have expiration dates, variable interest rates, or legal consequences. In these circumstances, neither method might be ideal in every situation, and you'll need an individualized debt payment plan example based on urgency.

Ultimately, the best method is the one you’ll actually follow. Don’t get stuck in theoretical benefits—choose the path you’re most likely to stick to every month.

Many people start with the snowball method to get early motivation and later transition to the avalanche once they’ve built some confidence. This hybrid approach leverages the strength of both debt repayment methods—early momentum and long-term savings.

You might start by eliminating the smallest debt just to feel forward progress, then you tackle the one that has the greatest interest rate to benefit the most. It's not "cheating"—it's being intelligent and knowledgeable.

Even in hybrid strategy, using a debt elimination calculator trick to plan and monitor your strategy will allow you to make course changes along the way as needed. All those small choices do add up in the marathon to financial independence.

There is no one-size-fits-all option in the snowball vs avalanche debate. Both are proven methods of paying back debt. The snowball builds psychological momentum. The avalanche is the financially superior choice by saving you interest when paying off debt. Both are technically one of the fastest ways of paying back debt, but from different directions—emotional wins or financial wins.

Whichever method you choose, make a plan, install a payment automation, and track your progress. Start with a solid debt repayment plan template, be it jotting down all your debts in a notebook or inputting them into an app. Then, attempt a side-by-side breakdown of the snowball and avalanche with a debt repayment calculator hack to work out what you're committing to. Debt freedom isn’t just a dream—it’s a decision. Choose your method, stay consistent, and enjoy the satisfaction of seeing that balance reach zero.

This content was created by AI